#DangerousDrives Statistics And Choosing Insurance For A Young Driver

Once upon a time, I worked for an insurance brokers and managed to get a fabulous staff discount on my car insurance – very handy when you are a seventeen year old who has just passed their test. Over the next few years always remember my father encouraging me to stay with my existing insurance provider so that I could earn rewards along the lines of long-term policy discounts, no claims discounts and more.

Fast forward a few more years and our middle child passed his driving test and needed to purchase young driver's insurance. To keep the cost down (we started at a premium of just over £2000 per year... yes really!!) he agreed to a mileage cap and to be part of a telematics programme which is essentially like having a 'black box' attached to the car that monitors your driving style and good driving is rewarded.

Fast forward a few more years and our middle child passed his driving test and needed to purchase young driver's insurance. To keep the cost down (we started at a premium of just over £2000 per year... yes really!!) he agreed to a mileage cap and to be part of a telematics programme which is essentially like having a 'black box' attached to the car that monitors your driving style and good driving is rewarded.

Has this brought us full circle, encouraging new drivers to stick with their existing insurance company for more than one year? And, as long as the renewal price is favourable, the driver and the company can start to build a long-lasting customer/provider relationship. If one company is prepared to make car insurance purchase easier and cheaper then that's definitely the option we are all going to head for!

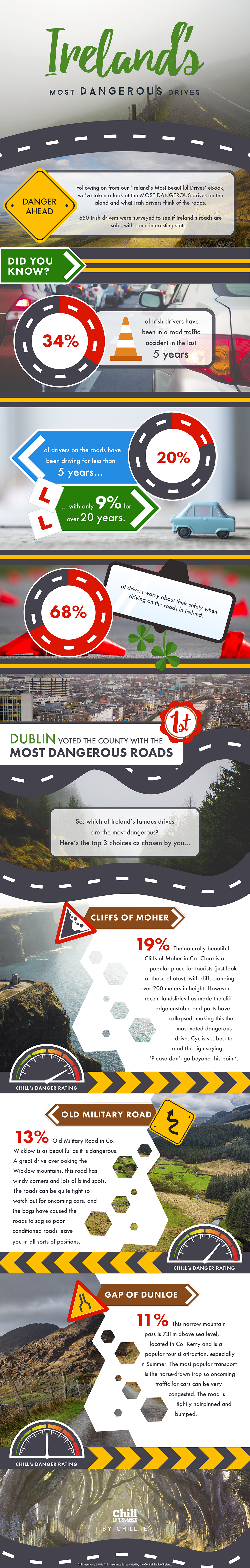

With this in mind, it's a great opportunity for me to share this infographic from Chill Insurance which shares some of the most dangerous drives in Ireland and some interesting driving statistics.

This is a collaborative post with Chill Insurance.

Please see my disclosure policy for more information.